I’ve been around the bitcoin space for a long time. Back in 2013 I held 16 BTC when each coin was about $125. I even had 4 Antminers humming in my basement, doing my own little-mining operation. But then the FBI seized bitcoins from the infamous Silk Road—and I thought, “That’s it. This whole thing is over.” So I sold. Big regret. Because Bitcoin didn’t vanish. It kept growing—even when I thought the game was done.

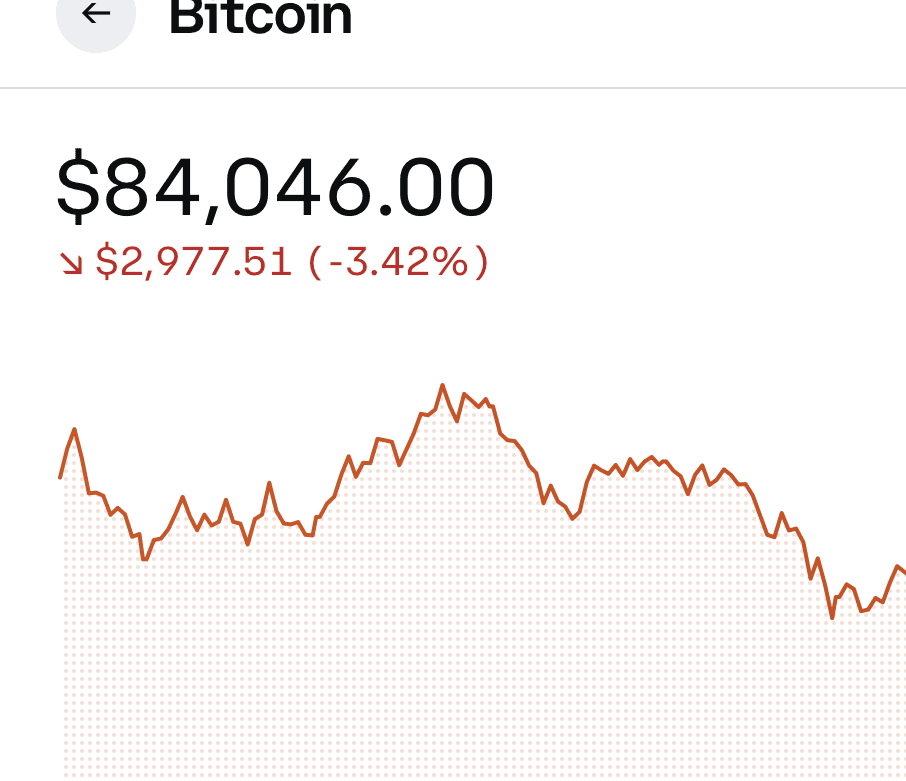

That personal experience gives me a different perspective now: I’m looking at the fall of Bitcoin and asking myself, why is it happening this time? And should I consider re-entering or is it too early?

What’s Causing the Recent Fall of Bitcoin

Here are the major drivers behind the decline in Bitcoin’s price. Each of them matters, and together they’ve weighed heavily.

1. Shift in market sentiment & liquidity withdrawal

Analysts point out that the market has flipped from greed to fear, which means capital is exiting crypto. EBC+1 Liquidity is drying up, especially among leveraged traders and institutions.

2. Forced liquidations & leverage unwind

Because so many traders were using significant leverage (borrowed money) to invest in BTC, when price started dropping, big liquidations followed. That accelerates further declines. New York Post+1

3. Risk-asset sell-off & macro factors

Bitcoin is no longer isolated. It’s behaving like a risk asset, tied to tech stocks and global sentiment. When broader markets pull back, Bitcoin often follows. Barron’s+1

4. Interest rate / monetary policy concerns

If central banks keep interest rates high, risk assets like crypto become less attractive relative to “safer” yield-bearing assets. That has weighed on BTC. Barron’s+1

5. Concentrated ownership / “whales” and mining / infrastructure pressures

Bitcoin’s supply is somewhat concentrated; large holders (“whales”) and miners with high costs may sell to cover expenses or realise profits. These actions add additional downward pressure. Investopedia

6. Technical / platform‐specific issues

There are also shorter-term triggers: software glitches, exchange issues, and sentiment shock can cause sharp drops. For example, a recent plunge was partially blamed on a price feed glitch. Yahoo Finance

If you’re thinking of buying Bitcoin now:

- Be aware you might still catch a falling knife.

- Decide how much risk you’re willing to accept.

- Decide your horizon (5 years? 10 years?).

- Make sure you believe in the why (why you’re owning it) not just the possibility of a short-term bounce.

Is It a Good Time to Buy Bitcoin? My View

Given all that, the question many of us ask: Is now a good time to buy Bitcoin? My answer: maybe—but with caution. Here’s how I see it.

Potential Advantages

- If you believe in the long-term narrative of Bitcoin (store of value, digital gold, inflation hedge, etc.), then price drops can be opportunities.

- Lower price = lower entry cost. If you missed earlier rallies and believe in future upside, this could be a chance.

- Many of the macro negatives might already be priced in—or at least partially so—so risk might be somewhat improved.

Risks & Why You Might Wait

- The macro environment is still unfavourable. If interest rates stay high or risk appetite stays low, Bitcoin could still slide.

- Because so much of the market is leverage-driven, there is still a risk of cascading liquidations and sharp downside.

- Entry timing matters. Buying “just after” a big drop can be dangerous—unless you’re prepared for further downside.

- Bitcoin remains extremely volatile and speculative. If you need the money (or fear big losses), it might not be worth jumping in now.

Continue to Learn

Given all this—and remembering I sold early in 2013—I would lean toward waiting for more clarity. Maybe a retest of lows, maybe improved macro signals, maybe lower leverage in the market. Once those things align, I’d feel more comfortable buying. If I were to buy now, I’d allocate a modest amount, treat it as a long-term hold, and brace for volatility.

Remember this is NOT financial advice. Just my opinion.